Top Trends Shaping the Future of Security Service Edge

The Security Service Edge revenue streams are primarily driven by a recurring, subscription-based model, which provides vendors with predictable and stable income. This model is highly attractive to both vendors and customers. For customers, it transforms a large upfront capital expenditure into a manageable operational expense, aligning costs with usage and value. For vendors, it fosters long-term customer relationships and continuous revenue generation. The primary revenue source is per-user, per-month or per-year licensing fees. These licenses are often tiered based on the level of functionality required; for example, a basic tier might include SWG and ZTNA, while a premium tier could add advanced CASB, DLP, and threat intelligence capabilities. This tiered approach allows vendors to cater to a wide range of customer needs and budgets, from small businesses to large multinational corporations, thereby maximizing their market penetration and revenue potential.

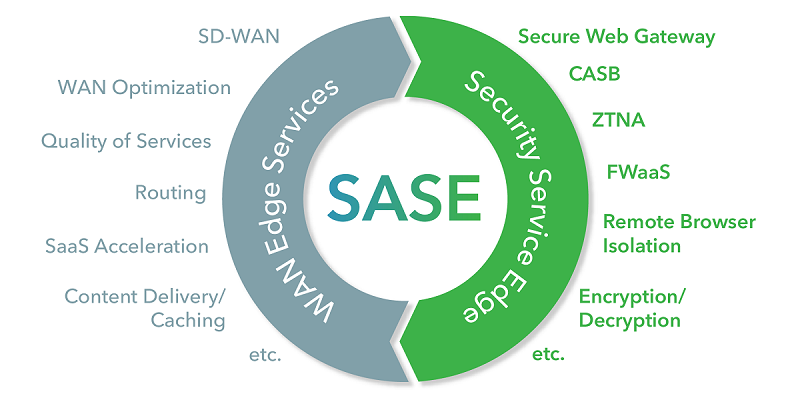

A deeper analysis of SSE revenue reveals that the different components of the platform contribute significantly to the overall earnings. While ZTNA is often the "killer app" that drives initial adoption by replacing clunky legacy VPNs, the SWG and CASB components are critical for long-term revenue growth and customer retention. SWG provides the essential web filtering and threat protection that all organizations need, while CASB is indispensable for securing the ever-growing number of SaaS applications like Microsoft 365, Salesforce, and Google Workspace. As organizations deepen their reliance on the cloud, the need for these integrated services grows, leading to upselling and cross-selling opportunities that further boost vendor revenue. Furthermore, professional services for implementation, integration, and ongoing management represent another important, albeit smaller, revenue stream for vendors and their channel partners.

Looking forward, the growth in Security Service Edge revenue is expected to accelerate as adoption moves from early adopters to the mainstream market. A key driver for future revenue growth will be the expansion into adjacent security domains and the introduction of new, high-value services. For instance, vendors are adding capabilities like Digital Experience Monitoring (DEM) to their platforms, allowing IT teams to proactively identify and resolve performance issues for remote users. This adds a new layer of value that goes beyond core security and can command premium pricing. Additionally, as SSE platforms collect vast amounts of security telemetry, there is a significant opportunity to monetize advanced analytics and AI-driven security insights, creating new, high-margin revenue streams and solidifying the financial foundation of the SSE market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness